Everything You Need to Know About Service Animal Tax Deductions

Updated May 30, 2023

: Expenses add up quickly if you own a pet. Costs can exceed $2000 a year with food, health treatments, grooming, etc. While pet parenting may feel like a full-time job, the IRS doesn’t seem to think so. The IRS has a list of requirements to claim someone as a dependent and your pet isn’t in it. But the scenario changes when it comes to a service animal. Since it shares a co-dependent relationship with the owner, the owner is eligible for service animal tax deductions.

Sounds like a relief? Not so fast. There are certain nuances that need to be met to qualify for service animal tax deductions. Let’s take a look.

How the IRS Defines a Service Animal for Taxpayers with Disabilities

The IRS recognizes service animals as working animals and not pets. They can be guide dogs, signal dogs, etc. that receive training directly related to their handler’s specific disability and provide assistance to them. Some of the tasks they can perform include:

- Guiding the visually impaired

- Guiding those who are hard of hearing

- Assisting those with limited mobility or mobility disorders

- Pulling a wheelchair

- Protecting a person having a seizure

- Reminding the handler to take medicine

- Assisting a person with Post Traumatic Stress Disorder (PTSD) during an anxiety attack

- Other disability-related tasks

What About Service Animals for Those With Mental Disorders?

While the above list mentions PTSD, the definition puts those with psychological, intellectual, psychiatric, and other categories of mental disorders in a gray area. The IRS eliminated this doubt in a 2010 letter to former Congressman, John Tanner that stated the following:

“The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the

disease or illness.”

Reasons Why a Service Animal is Tax Deductible

The cost of living with a disability, mental or physical, is high. Limited abilities limit work opportunities, thus causing financial strain. Many may not even be able to afford regular physician visits, medicines, and medical equipment. A service animal, while a necessity for many, is also an added expense. A service dog costs somewhere between $15,000 and $30,000 upfront. On top of that, the yearly ownership cost can vary between $500 to $10,000. No major insurance companies cover service animal expenses, which makes it even more difficult to bear the cost.

But these animals are still necessities. Just as any medical equipment like hearing aids, wheelchairs, travel expenses for medical care, etc., service dogs are considered medical aid for a disabled person, physical and mental. Therefore, they are a part of your medical expense, which makes them tax-deductible according to the IRS. So whether the service animal is for you, your spouse, or any of your dependents, the expenses are covered. This tax write-off helps a great deal in helping those with disabilities or a taxpayer whose family member is disabled live a better life.

Tax-Deductible Service Animal Expenses

So far, we have established that service animal tax deductions fall under the category of medical expenses on your taxes. However, you are only eligible if your medical expense exceeds 10% of your Adjusted Gross Income (AGI).

What is an AGI? Gross income includes wages, business income, dividends, and other income. AGI is your gross earning minus adjustments like student loan interests, contributions to a retirement account, alimony, etc.

If you qualify for service animal tax deductions, following are some of the costs that are considered tax deductible:

- Cost of buying a service animal

- Training cost

- Licensing fees

- Food expenses

- Veterinary fees

- Grooming cost

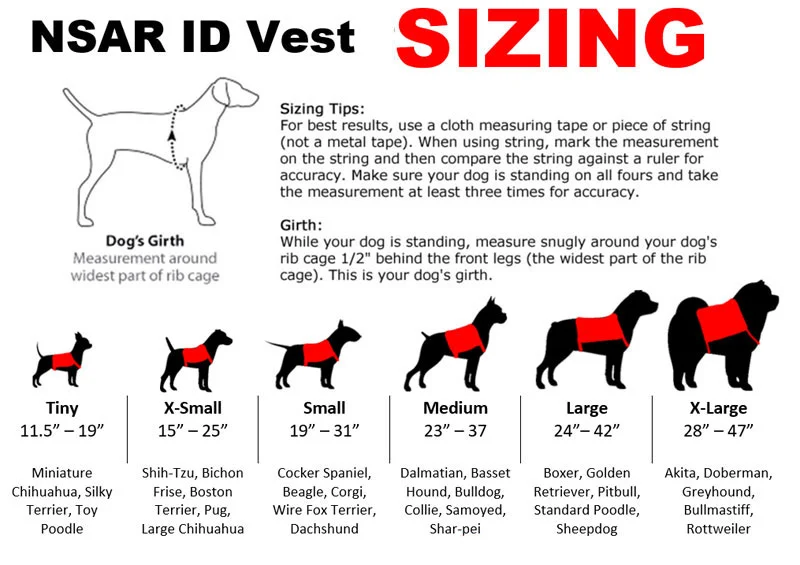

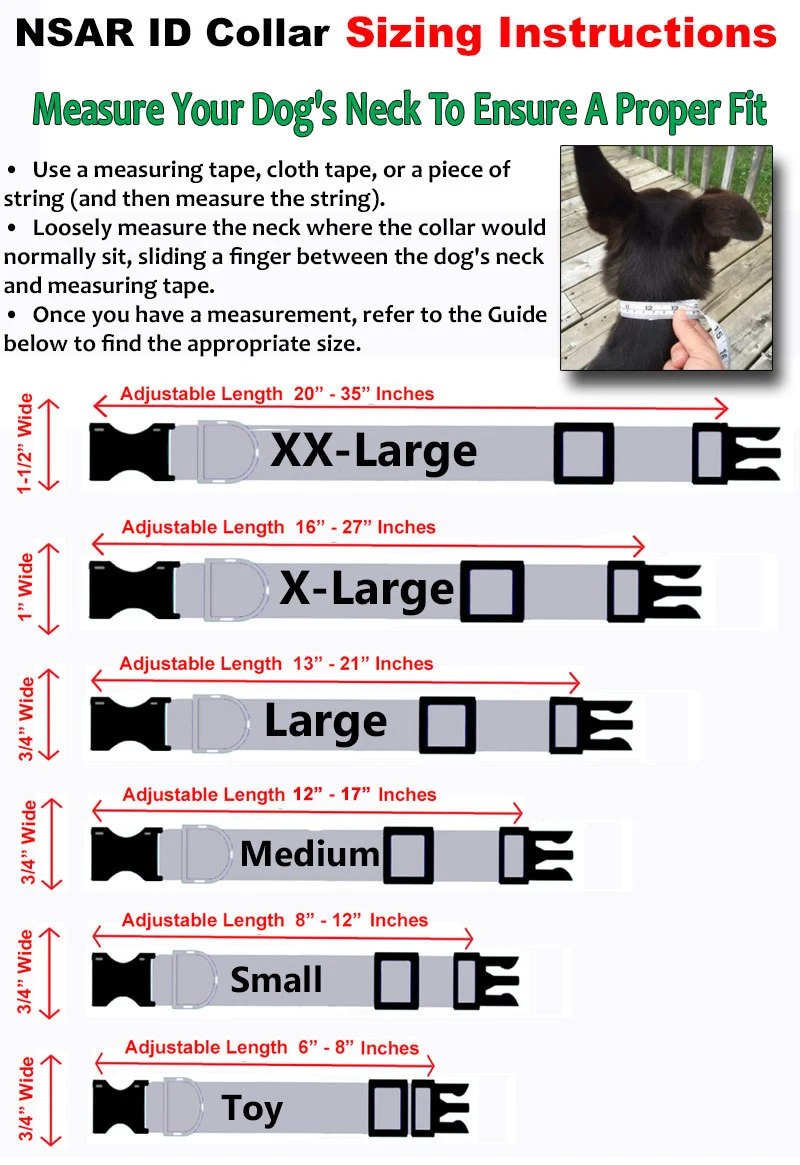

- Animal equipment like leashes, harnesses, vests, etc.

According to the IRS, all expenses incurred to maintain the vitality and health of the service animal to continue performing its duties are covered.

When is it Beneficial to Seek Service Animal Tax Deductions?

First, let’s talk about standardized deduction. It amounts to $12,950 when filing as a single taxpayer or as a married person filing separately. For a married couple filing jointly, the standardized deduction is $25,900. However, when you claim tax write-offs on your service animal expenses, you need to itemize your deductions by filing Schedule A on Form 1040.

While it may sound like a daunting task, it is worthwhile. However, it only makes sense to file itemized deductions if it exceeds your standard deduction. Otherwise, it’s all work, less return.

Another option is to claim ‘impairment-related work expenses’. This is less limiting than medical expense deductions. Who can qualify? Only those with a physical or mental disability that restricts employment opportunities for them or limits regular activities like walking, breathing, speaking, learning, performing manual tasks, etc.

Documents You Need to Claim Service Animal Tax Deductions

To be eligible for service animal tax deductions, you need to prove that the animal assists you with a diagnosed physical or mental disability. So you will need documentation from your physician and receipts of all qualified medical expenses. These documents will come in handy if the IRS decides to conduct an audit and comes calling at your door.

If you have a psychiatric condition that necessitates the use of a service animal, we can help with the documents. At National Service Animal Registry, when you register your psychiatric service dog (PSD) in our database, your dog gets a unique identification number which can be used by the IRS to verify the status of the animal, if required.

Additionally, we assist with psychiatric service dog letters. You can order a PSD letter on our website and we will give you an assessment to fill up. This will be reviewed by our licensed mental health practitioner (LMHP) and if you qualify, the letter will be delivered to you.

Information That a Psychiatric Service Dog Letter Must Include to Act as Proof for Tax Deductions

This letter is one of the primary documents to support your claim for service animal tax deductions. The Psychiatric Service Dog letter must be written on the official letterhead of the LMHP and contain the following details:

- Diagnosis of your impairment

- Requirement of a service dog to assist with your daily tasks

- Name and contact information of the LMHP

- License date and jurisdiction of LMHP

- Signature of LMHP

- Date of issue

Keep in mind that a PSD letter is valid for one year from the date of issue. So you will need to renew it to keep your tax documents updated to avail service animal tax deductions.

A Few Things to Keep in Mind

To be eligible for tax benefits related to service dogs, individuals must have a disability recognized under the ADA. This includes physical, sensory, mental, or emotional impairments that substantially limit one or more major life activities. Additionally, the service dog must be trained to perform specific tasks directly related to the individual’s disability.

- If your service dog expense is covered via a donation or is reimbursed from a source other than your income, you will not be able to claim service animal tax deductions

- Other animal-related expenses that are eligible for tax deduction include fostering pets, business animals, and taxable income from pets

- Your service animal should be harnessed, leashed, or tethered unless it interferes with its ability to perform its tasks

- A service animal is recognizable by the harness. If you are out in public, at a restaurant, seeking accommodation, etc. with your service dog, no one can ask you about the disability you have or ask you to have the dog demonstrate its tasks.

- Your service animal should be housebroken and under your control at all times when out in the public

Maximizing Potential Benefits for Service Dog Handlers: Service Animal Tax Deductions and More

Apart from tax implications, service dogs offer various benefits to their handlers. These include increased independence, improved safety and security, enhanced mobility, and emotional support. Service dogs are trained to assist individuals in various environments, enabling them to participate more fully in society.

Additionally, under the ADA, service dogs are granted certain rights and protections, such as being allowed access to public places, transportation, and housing, regardless of any pet-related restrictions or policies. These rights help ensure that individuals with disabilities can enjoy equal opportunities and accommodations.

Conclusion:

The aim of this blog is to inform you about the tax write-offs that you can claim if you own a service animal. However, it is not intended to serve as a financial guide for your tax decisions. It is always recommended to commission a tax specialist to help you navigate the intricacies of filing and ensure that you get every possible deduction you are eligible for.

If you need any help with the PSD letter or registering your service dog in our database, reach out to us at (719) 756-2634or send an email to info@nsarco.com. We would be happy to assist you.